Understanding Basic Personal Finance Math

Personal finance is essential for managing your wealth, ensuring financial security, and achieving your long-term goals. However, the thought of dealing with numbers and calculations can be intimidating. The truth is that the math involved in personal finance is straightforward and easy to grasp. In this article, we will explore some fundamental concepts, such as Absolute Return, Compound Annual Growth Rate (CAGR), Extended Internal Rate of Return (XIRR), and the Time Value of Money. These concepts form the bedrock of smart financial decision-making.

PERSONAL FINANCE

By ONE RUPEE

8/22/20242 min read

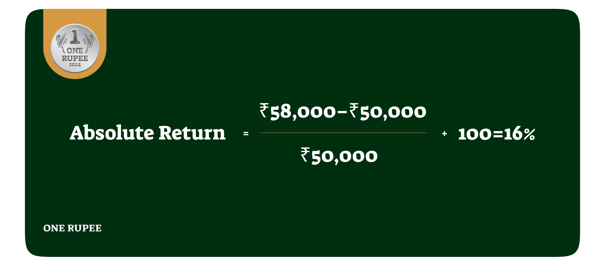

Absolute Return: A Basic Measure

Absolute return is the most basic way to measure how much your investment has grown. This method involves subtracting the initial investment amount from the final value, dividing the result by the initial value, and then multiplying by 100 to get a percentage.

Example:

Initial Investment: ₹50,000

Final Value: ₹58,000

Absolute Return Calculation:

While this method is simple, it does not consider how long the investment was held, which can be misleading when comparing returns from different time periods.

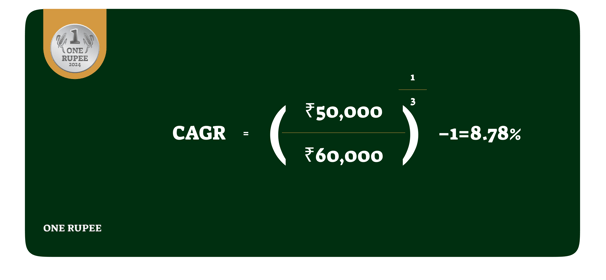

CAGR: Growth Rate Over Time

The Compound Annual Growth Rate (CAGR) accounts for the time period of an investment, providing a more accurate measure of performance over multiple years. CAGR represents the mean annual growth rate of an investment over a specified period of time longer than one year.

Example:

Initial Investment: ₹50,000

Final Value After 3 Years: ₹60,000

CAGR Calculation:

CAGR helps compare the growth rates of different investments over time, providing a clearer picture of which one performed better.

XIRR: Handling Multiple Investments

When you invest varying amounts at different times, the Extended Internal Rate of Return (XIRR) is used to calculate your overall return. XIRR is particularly useful for systematic investment plans (SIPs) or any scenario where cash flows are irregular.

Example:

Investment Over 3 Years: ₹25,000 each year, totaling ₹75,000

Final Value After 4 Years: ₹90,000

XIRR Calculation: The calculation for XIRR is more complex and typically requires software tools, but it gives a precise measure of return for cash flows spread out over time.

Time Value of Money: Understanding Present and Future Value

The Time Value of Money is a crucial concept in finance. It asserts that a sum of money has greater value today than the same sum will have in the future due to its potential earning capacity.

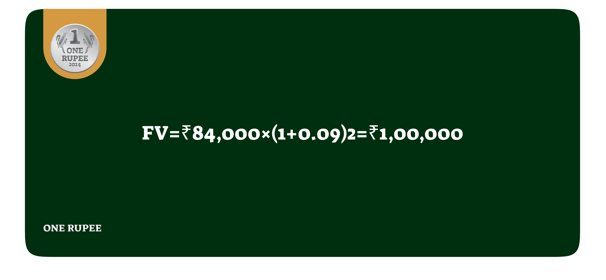

Future Value (FV)

Scenario: You have ₹84,000 today and can invest it at a 9% interest rate.

Future Value After 2 Years:

This calculation shows that investing ₹84,000 today would grow to ₹1,00,000 in two years.

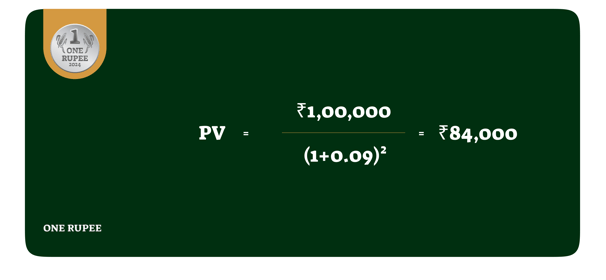

Present Value (PV)

Scenario: You are offered ₹1,00,000 two years from now.

Present Value Calculation:

Conclusion

Understanding basic personal finance math is essential for making informed investment decisions. Absolute Return, CAGR, XIRR, and the Time Value of Money are fundamental concepts that will help you evaluate and manage your investments effectively. By mastering these concepts, you can make better choices, maximize your returns, and build a secure financial future.

Simplifying your financial journey, one rupee at a time.

Quick Links

Disclaimer:

The content provided on the One Rupee blog is for informational purposes only and should not be considered as financial advice. While we strive to provide accurate and up-to-date information, we make no warranties regarding the completeness or accuracy of the content. Financial decisions are personal and should be made based on your individual circumstances. We recommend consulting with a financial advisor before making any investment or financial decisions. One Rupee is not responsible for any actions taken based on the information provided on this blog.

© 2024 One Rupee. All Rights Reserved.

Download now